Risk Management

Winbond is a semiconductor manufacturing company so natural disasters, accidents, and man-made events may all make a serious impact on production operations, financial management, information security and climate change. A risk management mechanism was therefore set up by Winbond for early warning and response. Strict risk engineering control, implementation and management of safety rules and guidelines ensure proper implementation of risk engineering control, safety of the semiconductor industry. The highest standards of the company’s financial and sustainable development policies. These help Winbond fulfill our vision f sustainable enterprise.

The World Economic Forum:The Global Risks Report 2020 stated that the top five long-term global risks havebnow gradually shifted from “economic problems” to “environmental problems” such as extreme weather”, “climate action failure”, “natural disasters”, “loss of biological diversity”, and “man-made environmental disasters.” Businesses around the world are increasingly coming under pressure from the deteriorating environmental and climate conditions. Winbond has added “climate change risk” as a long-term emerging risk to our long-term business management.

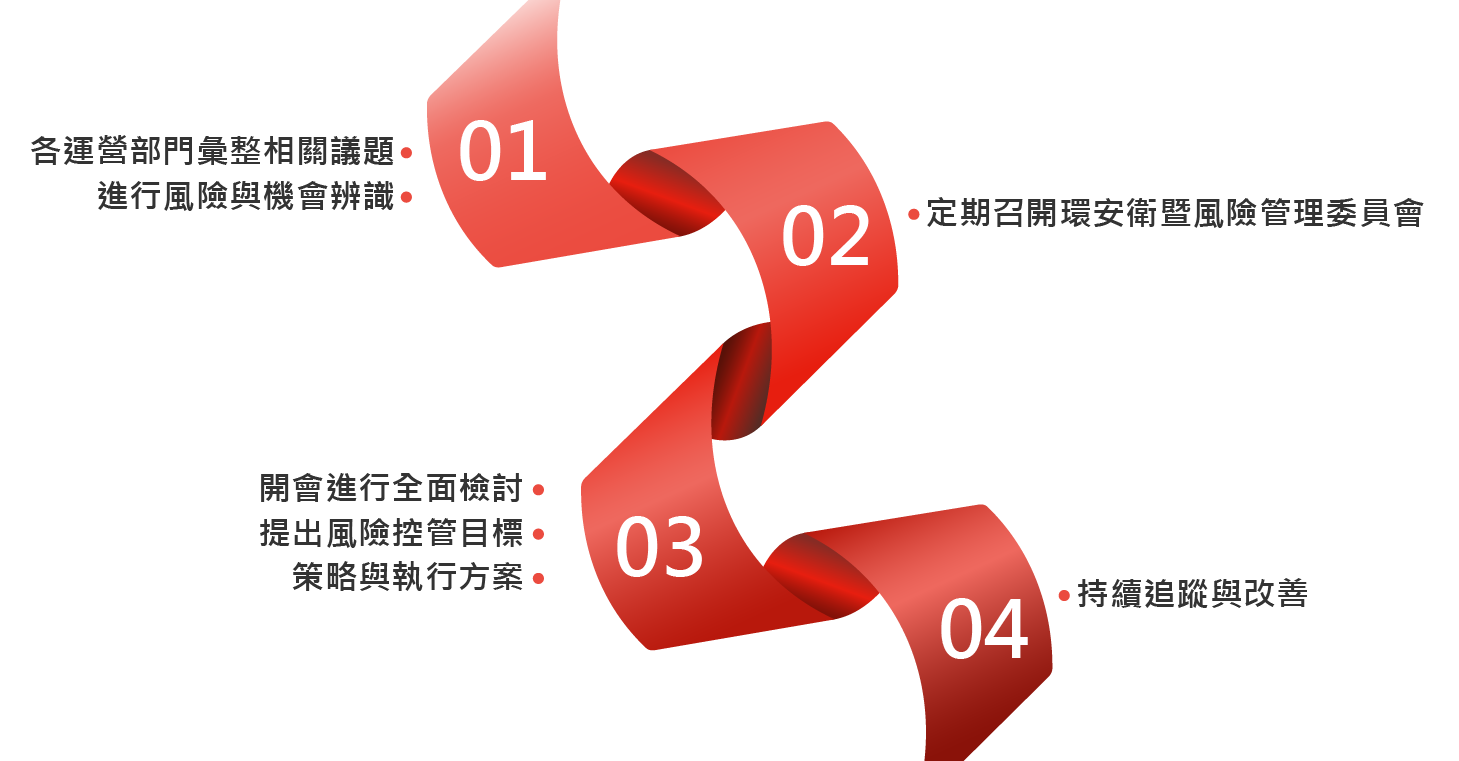

The “ESH and Risk Management Committee” is also convened quarterly to discuss management goals and devise response strategies. Discussion of climate change topics will also be added to “Executive Management Meetings” chaired by the Chairman to increase the level of management control. Progress on actions taken for related topics will also be tracked after the meeting to ensure that all corporate risk management goals can be met.

Three Major Business Risks

Three Major Business Risks

| Identification of Risks and Opportunities | Explanation of Impact Assessment | Response | Performance Management |

Business Risk Management |

|||

| Product Quality Anomaly | Loss of customer confidence and order cancellation. | Non-conforming products or processes must be immediately reported to personnel with the responsibility and authority for corrective action. They must ensure non-conforming products are not shipped to the customer and that all potential nonconforming products are identified and contained. The relevant units must analyze the cause and the impact on the production process then take improving action accordingly. | Strict quality controls and the improvement of product quality during the production process, that would help build long-term relationships with customers and increase satisfaction. |

| Infringement | Infringements may violate the law in severe cases that lead to civil and criminal liabilities for the management. Minor cases may also result in lead to financial damage or loss of business reputation for the company. |

|

Winbond respects IP rights of other parties and is willing to discuss for acquiring patent license if possible. This also could reduce litigation risks for the company. |

| Patent Risk | Impact on patent licensing negotiations and increases the risk of patent litigation. | In any circumstances the patent assignees , based on protecting their own patent rights, business strategy, requesting for high royalty payment or filing a law suit against Winbond, we will cooperate actively with outside counsels for proper responsive strategy. | By the following principle of mutually beneficial outcomes as well as interacting with patent assignees in a reasonable and respectful manner, Winbond has effectively controlled the patent risks and avoided negative impacts to the company. |

| Epidemic Risk | The COVID-19 pandemic led to factories being shut down and supply chain disruptions around the world. | Winbond monitors the latest COVID-19 developments as well as the production and business activities of vendors. Safety stock was also increased to deal with unexpected events. Strict epidemic prevention measures have also been implemented throughout the company including defined reporting processes, IR temperature screening, visitor management, rostered meal breaks, and regular disinfection. | The safety of our employees as well as supply of products have not been seriously affected by COVID-19 and we continued to operate as normal. |

Financial Business Risk Management |

|||

| Foreign Exchange Risk | The risk posed by changes in exchange rate from foreign currency transactions falls within the range permitted by the Procedures-for-Engaging-in-Financial-Derivatives-Transactions. Risk management is implemented through long-term foreign currency contracts. |

|

Net losses from current exchanges in 2020 (including gain/loss from derivative financial products) amounted to NT$59,741,000. This represented just 0.15% of annual operating income and 4.43% of net profit before tax for the year. Winbond engages in the trading of derivative financial products as a hedge against foreign exchange risk from fluctuations in the exchange rate for our net foreign asset position. In 2020, derivative financial products with exposure to foreign exchange risks amounted to USD 264,000,000 and RMB 54,000,000. An assessment of fair value placed total unrealized gains at around NT$38,380,000 so the potential gains and losses were all within the manageable range. |

| Interest Rate Risk | The main source of risk is long-term borrowings with a floating interest rate for production process upgrades or capacity expansion. | Winbond tries to secure more interest rate terms based on the market conditions at the time in order to reduce the impact from interest range changes. The company bonds issued by Winbond have a fixed interest rate, are priced in NTD and are based on the amortized cost. Their cash flow and fair value are therefore not affected by interest range changes. | In 2020, the consolidated net interest expenses amounted to NTD 249,455,000 and accounted for 0.41% of our consolidated operating income for the year. The impact interest rate changes on company operations were therefore assessed to be within the manageable range. Winbond will continue to monitor the impact of interest rate trends on cash flow. |

Information Risk Management |

|||

| Information Security |

|

|

|

|

|

|

|

Climate Change Response

Public Welfare Promotion

Winbond identified 3 climate change risk factors and 2 climate change opportunity factors using a climate related financial disclosure framework (TCFD), internal and external research reports, and the latest market observations. Effective response strategies were devised through our comprehensive risk management system to strengthen our management and practices on climate change events. Every possible is being done to respond to the risks and opportunities brought about by climate change. We are therefore doing our part for this land even as we continue to follow the path of sustainability.

Climate Change Risks

Climate Change Risks

| Climate Change Risks | Risk Description | Scope of Impact | Winbond Response Strategy |

| Increased cost of energy prices | GHG reduction requirements may impact on the cost of energy use due to higher energy prices and need to improve equipment performance. | Market price |

|

| More robust environmental regulation | Domestic environmental legislation is still being amended and is becoming stricter. | Operating cost | The responsible units are continuing to monitor and track related regulatory changes so that they can prepare in advance, in order to understand the risks involved and avoid non-compliance. |

| Amendments to the Renewable Energy Development Act increases the cost of energy use for businesses. | Operating cost | Continue to the evaluate the green electricity provisions for large electricity users and installation proportions for renewable energy equipment. | |

| The Greenhouse Gas Reduction and Management Act will impose caps on GHG emissions and a carbon tax. These may increase operating costs by raising the cost of GHG emissions and electricity. | Operating cost |

|

|

| Extreme rainfall and drought:Reduction/disruption of production. | Business interruption | Promote water-recycling technology and watersaving measures as well as devise response plan. Increase competitiveness by improving ability to adapt to climate changes. | |

| Production activities affected by climate disasters such as: flooding, drought, fire, heat, and heavy snow. These events may impact on the delivery time of raw materials. | Business interruption |

|

Climate Change Opportunities

Climate Change Opportunities

| Climate Change Opportunities | Opportunity Description | Scope of Impact | Winbond Response Strategy |

| Development and/or choose of low carbon emission or pollution-reducing ecofriendly products | Choose low carbon emission or pollution reducing eco-friendly products. | Market opportunities | Develop low carbon emission / pollution-reducing products with suppliers. |

| Use of recycling and resource saving purchases |

|

Operating cost | Collaborate with suppliers on recycling rojects. |